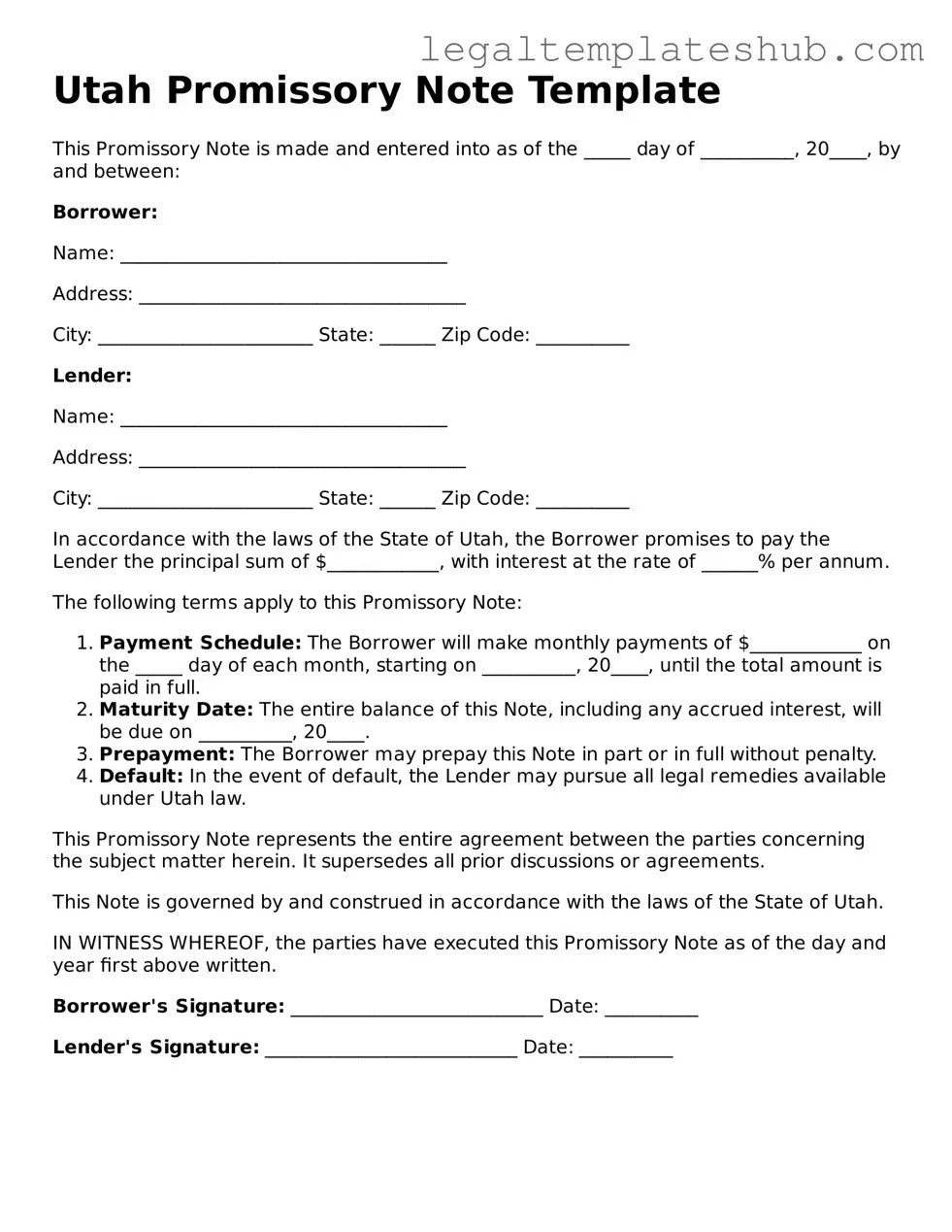

Printable Promissory Note Document for Utah

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Utah Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The laws governing promissory notes in Utah are found in the Utah Uniform Commercial Code (UCC), specifically Title 70A. |

| Parties Involved | The document typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable and must be clearly stated in the note. |

| Payment Terms | Payment terms should specify the due dates, frequency of payments, and total amount due. |

| Default Conditions | Conditions for default must be outlined, including any penalties or fees for late payments. |

| Signatures Required | Both parties must sign the note for it to be legally binding. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Transferability | The note can be transferred to another party, allowing the lender to sell or assign the note. |

| Enforcement | If the borrower defaults, the lender can take legal action to enforce the terms of the note. |

Key takeaways

When filling out and using the Utah Promissory Note form, there are several important points to keep in mind. Here’s a list of key takeaways to ensure you complete the form correctly and understand its implications.

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan. It serves as evidence of the debt.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This information is crucial for legal identification.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This should be a specific figure to avoid any confusion later.

- Detail the Interest Rate: If applicable, include the interest rate. Be explicit about whether it’s fixed or variable, as this affects repayment amounts.

- Outline Repayment Terms: Clearly define how and when the borrower will repay the loan. Include details about payment frequency and due dates.

- Include Default Terms: Specify what happens if the borrower fails to repay the loan. This may include late fees or legal actions.

- Signatures are Essential: Both parties must sign and date the document. This validates the agreement and makes it legally binding.

- Keep Copies: After the form is completed and signed, ensure that both the borrower and lender keep copies for their records. This is important for future reference.

By following these key takeaways, you can effectively navigate the process of filling out and using the Utah Promissory Note form. Understanding each component helps protect the interests of both parties involved.

Dos and Don'ts

When filling out the Utah Promissory Note form, it’s important to follow certain guidelines to ensure that the document is valid and enforceable. Here’s a list of what you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable, and ensure it complies with Utah laws.

- Don’t leave any sections blank; all fields must be completed.

- Don’t use vague language; be specific about the terms of repayment.

- Don’t forget to date the document when signing.

- Don’t overlook the importance of having witnesses or notarization if required.

More Promissory Note State Templates

How to Write a Promissory Note - It is essential for both parties to retain copies of the signed agreement for their records.

When preparing to complete a transaction, having the necessary documentation is crucial; thus, you can access the PDF Templates to help you fill out the New York Motorcycle Bill of Sale accurately, ensuring that all important information is recorded properly for both parties involved.

Create Promissory Note - Effective communication about the terms can prevent disputes in the future.

Free Loan Agreement Template Texas - This form can be customized to fit the needs of both the borrower and the lender.

Promissory Note Washington State - The note should specify what happens in case of a default, including legal recourse available to the lender.

Instructions on Filling in Utah Promissory Note

After obtaining the Utah Promissory Note form, you will need to fill it out carefully. Ensure you have all necessary information ready before you start. This process will involve providing details about the loan agreement between the borrower and the lender.

- Identify the parties: Write the name and address of the lender and the borrower at the top of the form.

- Loan amount: Clearly state the total amount of money being borrowed.

- Interest rate: Specify the interest rate for the loan. Make sure it’s clear whether it’s fixed or variable.

- Payment terms: Indicate how and when the borrower will make payments. Include details like monthly payment amounts and due dates.

- Maturity date: Write down the date when the loan must be fully repaid.

- Signatures: Both the lender and borrower need to sign the form. Include the date of signing.

- Witness or notarization: Depending on requirements, have a witness sign or get the document notarized for added validity.

Once the form is completed, ensure both parties keep a copy for their records. This will help in maintaining clarity and accountability throughout the loan period.

Misconceptions

-

Misconception 1: A Utah Promissory Note must be notarized to be valid.

In Utah, a promissory note does not need to be notarized to be legally enforceable. While notarization can provide an extra layer of authenticity and help prevent disputes, the absence of a notary does not invalidate the note itself.

-

Misconception 2: All promissory notes in Utah must follow a specific template.

While it is advisable to use a clear and structured format, Utah law does not mandate a specific template for promissory notes. The essential requirement is that the note clearly outlines the terms of the loan, including the amount, interest rate, and repayment schedule.

-

Misconception 3: A verbal agreement can replace a written promissory note.

Although verbal agreements can be legally binding, they are often difficult to enforce. A written promissory note provides clear evidence of the terms agreed upon by both parties, making it a more reliable option in case of disputes.

-

Misconception 4: Promissory notes are only for large loans.

Promissory notes can be used for loans of any size. Whether the loan amount is small or large, a written note serves to protect both the lender and the borrower by clearly stating the terms of the agreement.