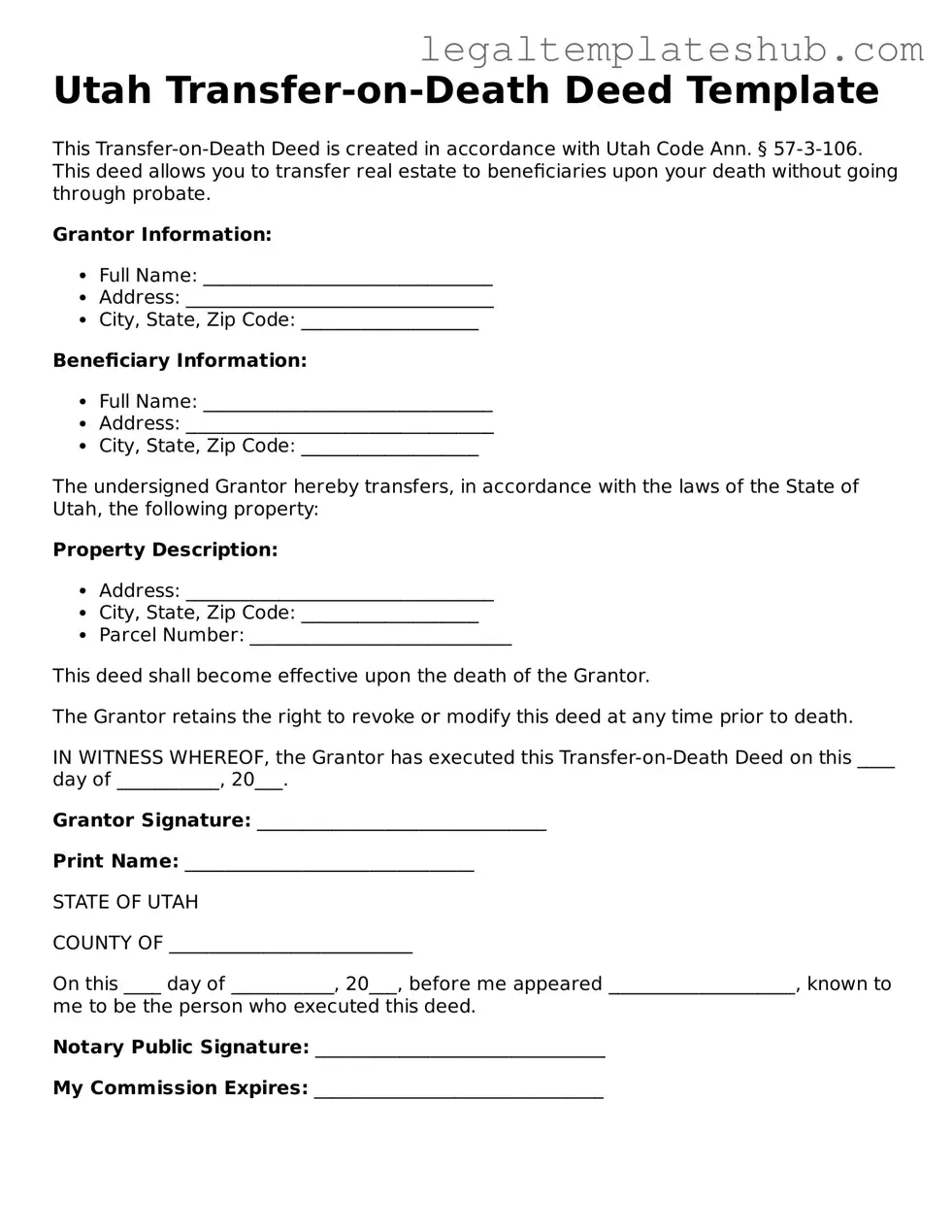

Printable Transfer-on-Death Deed Document for Utah

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | Utah Code Title 75, Chapter 6, Section 1201 governs the use of Transfer-on-Death Deeds in Utah. |

| Eligibility | Any individual who owns real property in Utah can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Multiple beneficiaries can be named in the deed, and each can receive a specified share of the property. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the death of the owner by executing a new deed or a written revocation. |

| Filing Requirement | The deed must be recorded with the county recorder's office in the county where the property is located to be effective. |

| Effect on Creditors | The property transferred via a Transfer-on-Death Deed may still be subject to the deceased owner's debts and creditors' claims. |

Key takeaways

Filling out and using the Utah Transfer-on-Death Deed form can be a straightforward process, but it is essential to understand the key aspects involved. Here are some important takeaways to consider:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property upon their death, avoiding probate.

- To create a valid deed, the property owner must be at least 18 years old and legally capable of making decisions regarding their property.

- The form must be filled out completely, including the legal description of the property, which is crucial for clarity and accuracy.

- It is important to sign the deed in the presence of a notary public to ensure that it is legally binding.

- Once completed, the deed must be recorded with the county recorder's office where the property is located to be effective.

- Beneficiaries can be changed or revoked at any time before the property owner’s death, providing flexibility in estate planning.

- Consulting with an attorney can provide additional guidance and ensure that all legal requirements are met, especially for complex situations.

By understanding these key points, individuals can better navigate the process of using a Transfer-on-Death Deed in Utah, ensuring their wishes are honored while simplifying the transfer of property to loved ones.

Dos and Don'ts

When filling out the Utah Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are five things you should and shouldn’t do:

- Do provide accurate property descriptions. Ensure that the legal description of the property is complete and precise.

- Do include the full names of all parties involved. This helps prevent any confusion regarding ownership.

- Do sign the form in front of a notary. A notary public must witness your signature to validate the document.

- Don’t leave any sections blank. Fill out every required field to avoid delays or issues.

- Don’t forget to record the deed. Submit the completed form to the appropriate county recorder’s office to make it legally effective.

More Transfer-on-Death Deed State Templates

What Are the Disadvantages of a Transfer on Death Deed? - Beneficiaries receive ownership without court involvement.

Can a Beneficiary Deed Be Contested - Keep the interests of your heirs prioritized by utilizing this simple transfer method.

To facilitate the legal process of transferring ownership, individuals are encouraged to utilize the PDF Templates available for the New York Mobile Home Bill of Sale form, which ensures that all necessary information is accurately recorded and compliant with state laws.

Virginia Tod Deed - Designating a beneficiary through a Transfer-on-Death Deed is a straightforward process that offers valuable long-term benefits.

Affidavit for Transfer Without Probate Ohio - With a Transfer-on-Death Deed, you can avoid the hassle of an estate plan that’s unnecessarily complicated.

Instructions on Filling in Utah Transfer-on-Death Deed

Once you have the Utah Transfer-on-Death Deed form ready, it's time to fill it out carefully. This form allows you to designate a beneficiary for your property after your passing. Ensure you have all necessary information at hand to make the process smoother.

- Begin by entering your name and address in the designated fields. This identifies you as the property owner.

- Provide a clear description of the property you are transferring. Include the address and any legal descriptions necessary.

- Next, identify the beneficiary or beneficiaries. This is the person or people who will receive the property upon your death. Include their full names and addresses.

- Indicate whether the transfer will be to one beneficiary or multiple beneficiaries. If multiple, clarify how the property will be divided among them.

- Sign and date the form. Make sure to do this in front of a notary public to ensure the document is legally binding.

- Once notarized, make copies of the completed form for your records and the beneficiary.

- Finally, file the original deed with the county recorder's office in the county where the property is located. This step is crucial for the transfer to take effect.

After completing these steps, your Transfer-on-Death Deed will be officially recorded. This ensures that your wishes regarding the property are clear and legally recognized. Always keep a copy for your records and inform your beneficiaries about the deed.

Misconceptions

Understanding the Utah Transfer-on-Death Deed form is crucial for anyone considering estate planning. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this form:

- It only applies to real estate. Many believe the Transfer-on-Death Deed is limited to real property. While it is primarily used for real estate, it does not cover personal property or financial accounts.

- It is the same as a will. Some individuals confuse this deed with a will. Unlike a will, which goes through probate, a Transfer-on-Death Deed allows for direct transfer of property upon death, bypassing the probate process.

- It can be revoked easily. Although the deed can be revoked, it requires specific procedures. Simply changing your mind does not invalidate the deed without following the proper steps.

- All heirs must agree to the deed. This is a common misunderstanding. The Transfer-on-Death Deed allows the owner to designate a beneficiary without needing consent from other potential heirs.

- It automatically transfers all property. The deed only transfers the property explicitly mentioned in it. Any property not listed remains part of the estate and may be subject to probate.

- It is only for married couples. This misconception limits its use. Anyone can utilize the Transfer-on-Death Deed, regardless of marital status, to designate beneficiaries.

- It is a complicated process. While legal documents can seem daunting, completing a Transfer-on-Death Deed is relatively straightforward. Many resources are available to assist individuals in filling it out correctly.

- It affects property ownership while alive. The deed does not change ownership during the owner’s lifetime. The property remains under the owner’s control until death.

- It is only for those with significant assets. This is a misconception. Even individuals with modest properties can benefit from a Transfer-on-Death Deed to simplify their estate planning.

Clearing up these misconceptions can lead to more informed decisions about estate planning and the use of the Transfer-on-Death Deed in Utah.