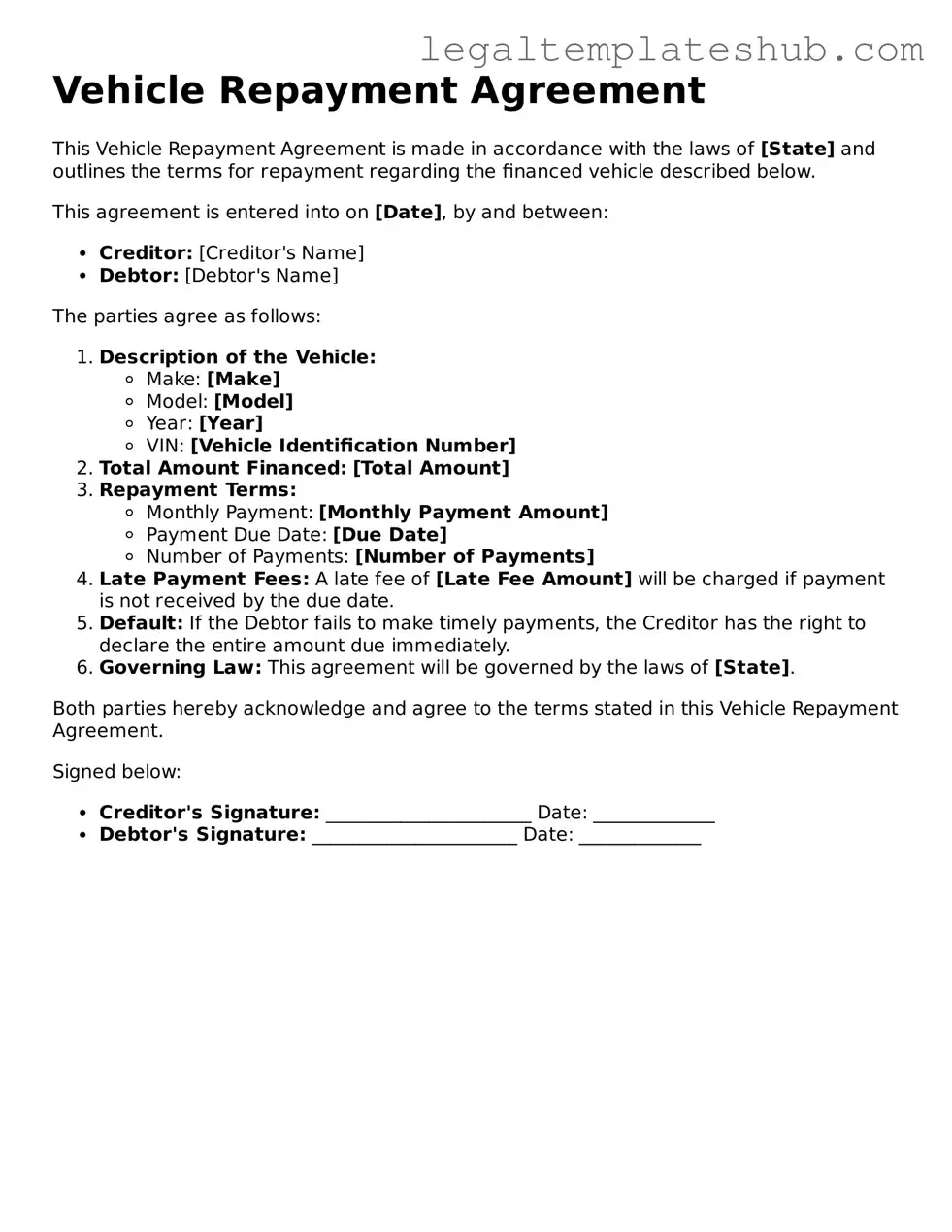

Printable Vehicle Repayment Agreement Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms of repayment for a vehicle loan or lease. |

| Parties Involved | The form typically involves the borrower (individual or entity) and the lender (financial institution or individual). |

| Governing Law | In many states, the agreement is governed by the Uniform Commercial Code (UCC), which regulates secured transactions. |

| Key Terms | Important terms include the loan amount, interest rate, repayment schedule, and consequences of default. |

| Signature Requirement | Both parties must sign the form to indicate agreement to the terms outlined. |

| State Variations | Some states may have specific requirements or additional disclosures that must be included in the agreement. |

| Documentation | Supporting documents, such as proof of income or vehicle registration, may be required when submitting the form. |

| Enforcement | If either party fails to comply with the agreement, the other party may seek legal remedies based on the terms outlined. |

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, it is essential to understand the following key points:

- Complete All Sections: Ensure that every section of the form is filled out accurately. Missing information can lead to delays or complications.

- Provide Accurate Vehicle Details: Include the correct make, model, year, and Vehicle Identification Number (VIN) of the vehicle. This information is crucial for identifying the asset involved in the agreement.

- Clearly State Payment Terms: Outline the repayment schedule, including the amount due, frequency of payments, and due dates. Clarity helps prevent misunderstandings between parties.

- Include Contact Information: Provide current contact details for all parties involved. This ensures that communication remains open and effective throughout the repayment period.

- Signatures Are Mandatory: Both parties must sign the agreement. Without signatures, the document may not be legally binding.

- Keep Copies: After the agreement is signed, make copies for all parties involved. This serves as a reference and provides proof of the agreement.

- Review the Agreement Regularly: Periodically revisit the terms of the agreement to ensure compliance and address any changes that may arise.

- Consult a Professional if Needed: If there are any uncertainties or questions about the agreement, consider seeking advice from a legal professional to ensure that all parties are protected.

By following these guidelines, individuals can navigate the Vehicle Repayment Agreement process with greater confidence and clarity.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information about the vehicle and repayment terms.

- Do double-check all numbers and dates for accuracy.

- Do sign and date the form where indicated.

- Don't leave any required fields blank.

- Don't use white-out or make alterations on the form.

- Don't submit the form without making a copy for your records.

Common Templates:

Affidavit of Affixture Form - Professionals can guide homeowners through the affidavit's completion.

Workmanship Warranty Example - The issuing date noted on the certificate is crucial for determining the warranty's activation and duration.

For those looking to navigate the complexities of potential investments, the critical Investment Letter of Intent process can serve as an essential starting point, outlining the initial commitments and expectations between involved parties.

Letter of Interest for Grant - Outline the strategies you'll use to achieve your project goals.

Instructions on Filling in Vehicle Repayment Agreement

After completing the Vehicle Repayment Agreement form, you will submit it to the appropriate department for processing. Ensure all information is accurate to avoid delays. Follow these steps carefully to fill out the form correctly.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and ZIP code.

- Fill in your phone number and email address for contact purposes.

- Enter the vehicle identification number (VIN) of the vehicle in question.

- Specify the make, model, and year of the vehicle.

- Indicate the total amount owed on the vehicle.

- State the repayment amount you propose.

- Choose the repayment frequency (e.g., weekly, bi-weekly, monthly).

- Sign and date the form at the bottom to confirm your agreement.

Misconceptions

When it comes to the Vehicle Repayment Agreement form, several misconceptions can create confusion. Here’s a breakdown of some common misunderstandings:

- It's only for people with poor credit. Many believe that this form is exclusively for those with low credit scores. In reality, anyone financing a vehicle can benefit from a repayment agreement.

- Signing means you can't negotiate terms. Some think that once they sign the agreement, they lose the ability to negotiate. However, terms can often be discussed before finalizing the document.

- It’s a legally binding contract immediately. While the agreement becomes binding once signed, it may still be subject to approval by the lender, meaning it isn’t finalized until all parties agree.

- It covers only the vehicle’s purchase price. Many assume the form only pertains to the vehicle's cost. In fact, it can include additional fees like taxes, insurance, and registration.

- Once you sign, you can't back out. Some people think they are locked in once they sign the form. There are usually provisions that allow for cancellation within a specific timeframe.

- All lenders use the same form. It’s a common belief that the Vehicle Repayment Agreement is standardized. However, different lenders may have their own versions with varying terms.

- It’s only necessary for loans over a certain amount. Some think the agreement is only needed for high-value loans. In truth, it is relevant for any vehicle financing, regardless of the amount.

- It guarantees loan approval. Signing the agreement does not ensure that the loan will be approved. Lenders still need to assess your financial situation and creditworthiness.

- It’s a complicated document. Many view the Vehicle Repayment Agreement as overly complex. In reality, it is designed to be straightforward, outlining key terms and responsibilities clearly.

Understanding these misconceptions can help you navigate the Vehicle Repayment Agreement form with confidence and clarity.