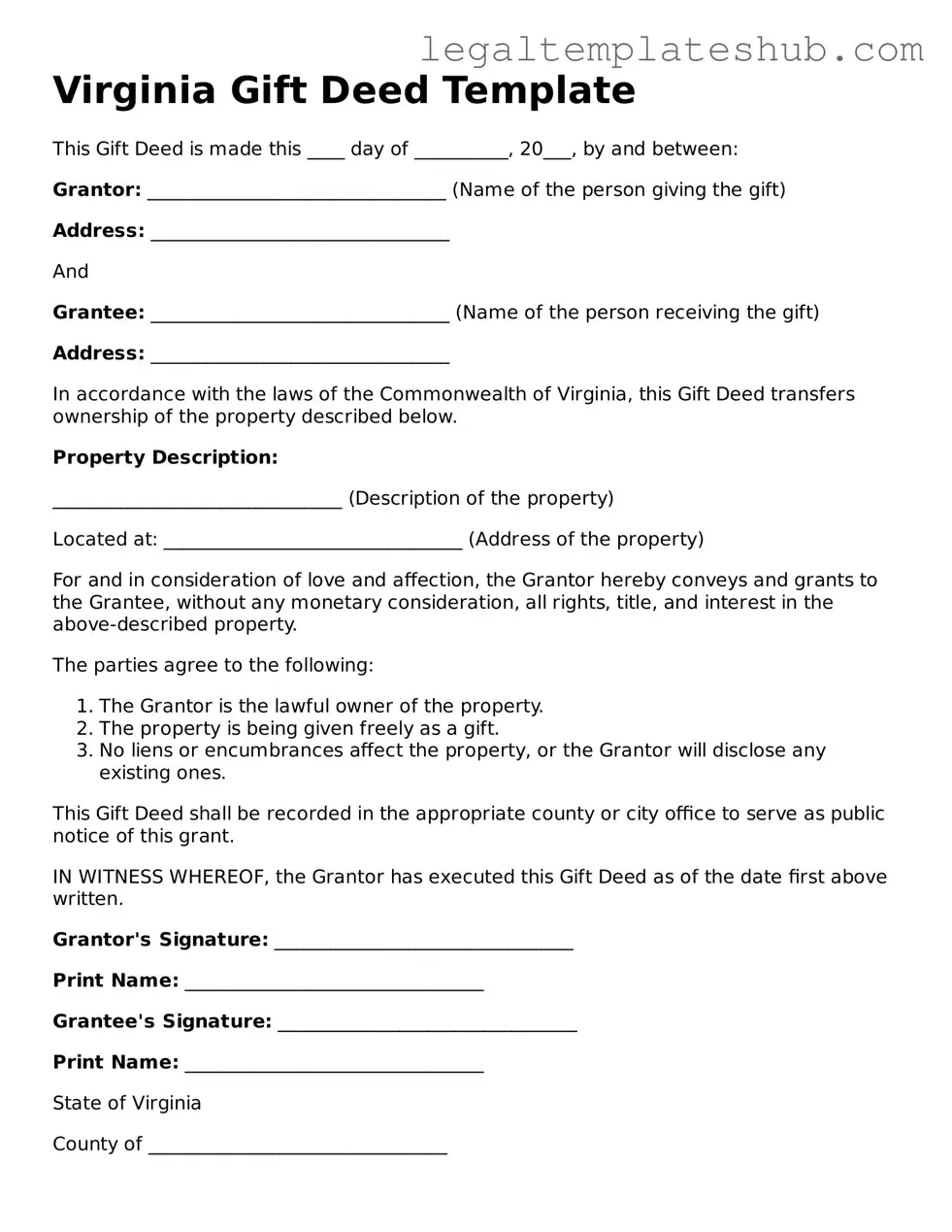

Printable Gift Deed Document for Virginia

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Virginia Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Virginia Gift Deed is governed by Virginia Code § 55.1-600 et seq. |

| Requirements | The deed must be in writing and signed by the donor (the person giving the gift). |

| Notarization | A Gift Deed must be notarized to be legally valid in Virginia. |

| Consideration | No monetary consideration is required for a Gift Deed; it is a voluntary transfer. |

| Acceptance | The recipient (donee) must accept the gift for the transfer to be effective. |

| Property Types | Real estate, personal property, and intangible assets can be transferred using a Gift Deed. |

| Tax Implications | Gift taxes may apply, and both the donor and donee should consult tax professionals. |

| Recording | The Gift Deed should be recorded in the county where the property is located for public notice. |

| Revocation | Once executed, a Gift Deed is generally irrevocable unless specific conditions are met. |

Key takeaways

When filling out and using the Virginia Gift Deed form, there are several important points to consider. Understanding these key takeaways can help ensure the process goes smoothly.

- Purpose of the Gift Deed: The Virginia Gift Deed is used to transfer property ownership from one person to another without any exchange of money. This document formalizes the gift and provides legal recognition.

- Completing the Form: Ensure all required fields are filled out accurately. This includes the names of both the donor (the person giving the gift) and the recipient (the person receiving the gift), as well as a clear description of the property being transferred.

- Signatures and Notarization: The Gift Deed must be signed by the donor. In Virginia, the signature needs to be notarized to make the document legally binding. This adds an extra layer of authenticity.

- Recording the Deed: After completing and notarizing the Gift Deed, it should be recorded with the local county clerk's office. This step is crucial as it updates public records and protects the recipient’s ownership rights.

- Tax Implications: Be aware of potential tax consequences. While gift tax may not apply in all situations, it is wise to consult a tax professional to understand any implications for both the donor and the recipient.

By keeping these key points in mind, individuals can navigate the process of using a Virginia Gift Deed with greater confidence and clarity.

Dos and Don'ts

When filling out the Virginia Gift Deed form, it's essential to follow specific guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do ensure that all names are spelled correctly.

- Do provide accurate property descriptions.

- Do include the date of the gift.

- Do have the form notarized to validate the deed.

- Don't leave any sections blank; fill in all required information.

- Don't use outdated forms; always check for the latest version.

- Don't forget to file the deed with the local county clerk's office.

Following these guidelines will help avoid potential issues and ensure the gift deed is processed without complications.

More Gift Deed State Templates

Texas Gift Deed - A Gift Deed outlines the terms of the property transfer to prevent misunderstandings.

For a seamless transaction and to avoid any misunderstandings, it is essential to utilize a proper form, such as the California Vehicle Purchase Agreement form, which can be found at https://californiapdf.com/editable-vehicle-purchase-agreement. This document ensures that both the buyer and seller are aware of the terms and conditions, making the process more efficient and legally binding.

Instructions on Filling in Virginia Gift Deed

Filling out the Virginia Gift Deed form is a straightforward process. Once completed, you will need to file the deed with your local clerk’s office to make the transfer official. Follow these steps to ensure accuracy and compliance with state requirements.

- Obtain the form: Download the Virginia Gift Deed form from the Virginia Department of Taxation website or your local clerk’s office.

- Fill in the grantor's information: Enter the full name and address of the person giving the gift.

- Fill in the grantee's information: Provide the full name and address of the person receiving the gift.

- Describe the property: Clearly state the property being transferred, including its address and any relevant legal descriptions.

- Indicate the consideration: Write "love and affection" or specify any other consideration for the gift, if applicable.

- Sign the form: The grantor must sign the form in the presence of a notary public.

- Notarization: Have the notary public complete their section, verifying the grantor's identity and signature.

- File the deed: Submit the completed and notarized Gift Deed form to your local clerk’s office for recording.

After filing, keep a copy of the recorded deed for your records. This document serves as proof of the property transfer and may be necessary for future transactions or legal matters.

Misconceptions

When it comes to the Virginia Gift Deed form, several misconceptions often arise. Understanding these can help individuals navigate the process more effectively.

- Misconception 1: A Gift Deed is the same as a Will.

- Misconception 2: You don’t need to record a Gift Deed.

- Misconception 3: A Gift Deed can be revoked at any time.

- Misconception 4: All gifts are tax-free.

This is not true. A Gift Deed transfers ownership of property immediately while a Will only distributes assets upon death. A Gift Deed is a present transfer, whereas a Will involves future intentions.

While it is not legally required to record a Gift Deed, doing so is highly advisable. Recording the deed provides public notice of the transfer, which can prevent disputes and establish clear ownership.

Once a Gift Deed is executed and delivered, it generally cannot be revoked. This is because the transfer of ownership is considered complete. If someone wishes to reverse the transaction, they would need to take additional legal steps.

This is misleading. While many gifts may not incur taxes, there are limits to the value of gifts that can be given tax-free each year. It is important to be aware of these limits to avoid unexpected tax liabilities.