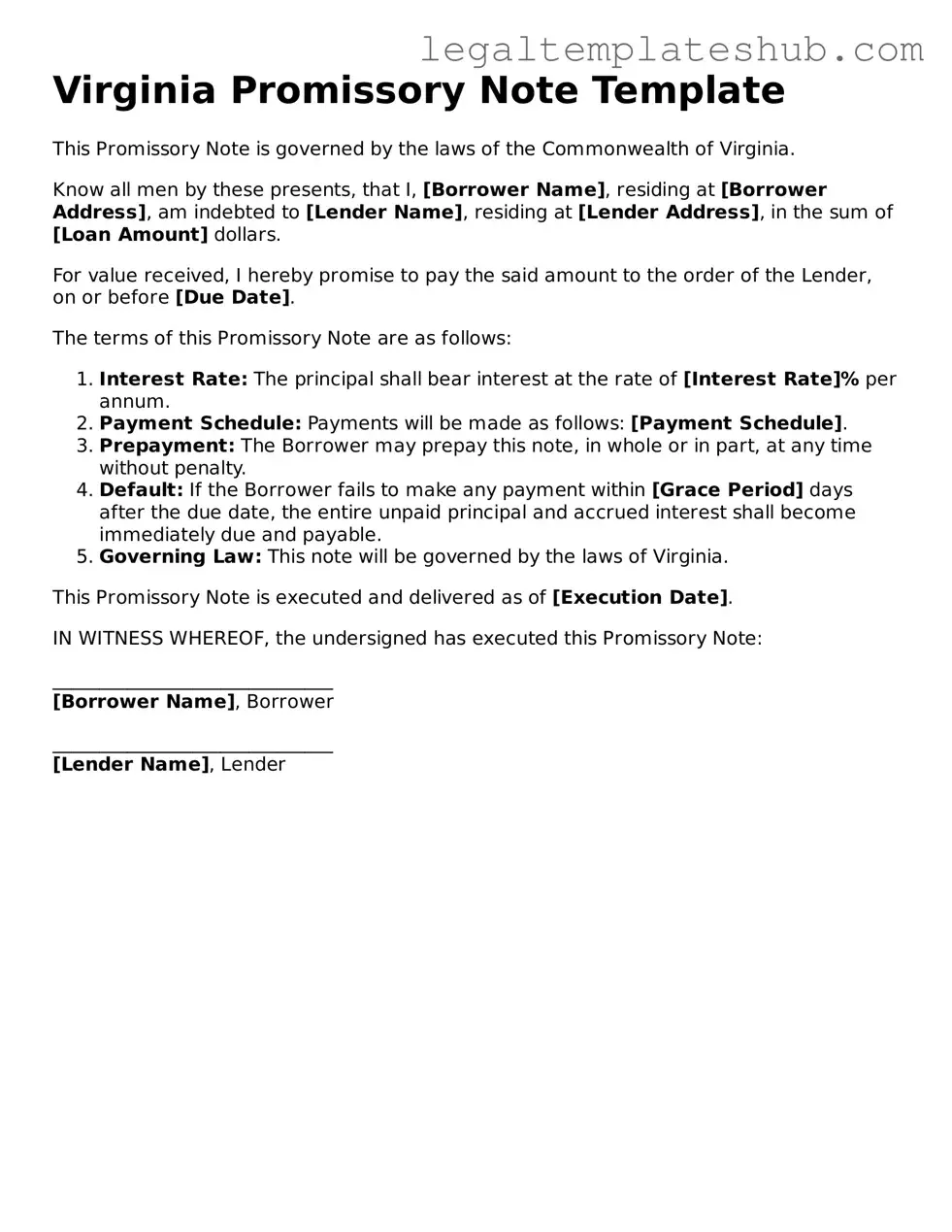

Printable Promissory Note Document for Virginia

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Virginia Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Virginia Uniform Commercial Code (UCC), specifically Article 3, governs promissory notes in Virginia. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, depending on the agreement between the parties. |

| Signatures Required | The maker must sign the note to validate it, and it may also require the lender's signature in some cases. |

| Enforceability | For a promissory note to be enforceable, it must meet certain legal requirements, including clarity of terms and intent to pay. |

Key takeaways

When filling out and using the Virginia Promissory Note form, there are several important considerations to keep in mind.

- Clear Terms: Ensure that the terms of the loan are clearly stated, including the amount borrowed, interest rate, and repayment schedule.

- Signatures Required: Both the borrower and lender must sign the document for it to be legally binding.

- Consider Notarization: Although notarization is not always required, having the document notarized can provide an additional layer of security and authenticity.

- Keep Copies: Both parties should retain a signed copy of the Promissory Note for their records.

By following these guidelines, you can help ensure that the Promissory Note serves its intended purpose effectively.

Dos and Don'ts

When filling out the Virginia Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Here are some dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and lender.

- Do clearly state the amount of money being borrowed.

- Do specify the interest rate, if applicable.

- Don't leave any required fields blank.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to include the repayment terms.

- Don't sign the document without reviewing it thoroughly.

More Promissory Note State Templates

Promissory Note Template Ohio - Serves as a written commitment to repay a loan under agreed terms.

Nc Promissory Note - It is crucial to maintain copies of the note for both the borrower and lender for records.

When finalizing the details of a vehicle sale in California, it's essential to utilize the California Vehicle Purchase Agreement form, which can be found at https://californiapdf.com/editable-vehicle-purchase-agreement/. This document ensures clarity on the terms and conditions, serving not only as a guideline but also as a binding contract that facilitates a smooth and legal transaction.

How to Write a Promissory Note - The document may offer different repayment methods, including lump-sum or installments.

Promissory Note Washington State - Promissory notes can be unsecured or secured by collateral, depending on the agreement.

Instructions on Filling in Virginia Promissory Note

After obtaining the Virginia Promissory Note form, you will need to fill it out accurately to ensure that all necessary information is included. This document will serve as a written promise to repay a loan under specified terms. Following the completion of the form, both parties should review the document for clarity and understanding before signing.

- Begin by entering the date at the top of the form. This should reflect the date you are completing the note.

- Identify the borrower by writing their full legal name in the designated space. Make sure to include any middle names or initials.

- Next, enter the lender's full legal name. Similar to the borrower, include any middle names or initials for clarity.

- Specify the principal amount of the loan. This is the total sum that the borrower agrees to repay.

- Indicate the interest rate, if applicable. This is the percentage of the principal that will be charged as interest.

- Detail the repayment schedule. This includes the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. Clearly state the conditions under which these fees will apply.

- Provide a section for any prepayment options. Specify whether the borrower can pay off the loan early without penalty.

- Leave space for both parties to sign and date the document. Ensure that the signatures are clear and legible.

Once you have completed these steps, review the entire form to ensure accuracy. Both the borrower and lender should retain copies of the signed document for their records.

Misconceptions

Misconceptions about the Virginia Promissory Note form can lead to confusion and mismanagement of financial agreements. Here are nine common misconceptions:

-

All Promissory Notes are the Same:

Many people believe that all promissory notes are identical. In reality, each note can vary significantly in terms of terms, conditions, and legal requirements based on state laws and the specifics of the agreement.

-

A Promissory Note is a Loan Agreement:

Some confuse a promissory note with a loan agreement. While a promissory note is a written promise to pay a specified amount, a loan agreement encompasses broader terms, including interest rates and repayment schedules.

-

Promissory Notes Must Be Notarized:

It is a common belief that notarization is mandatory for a promissory note to be valid. However, notarization is not required in Virginia, though it can add an extra layer of authenticity.

-

Only Banks Can Issue Promissory Notes:

Many think that only financial institutions can create promissory notes. In fact, individuals can issue promissory notes to one another for personal loans or other financial arrangements.

-

Promissory Notes Are Non-Enforceable:

Some assume that promissory notes hold no legal weight. On the contrary, a properly executed promissory note is a legally binding document that can be enforced in court.

-

Interest Rates Are Fixed:

There is a misconception that all promissory notes have fixed interest rates. In reality, the interest rate can be variable or fixed, depending on the terms agreed upon by the parties involved.

-

Repayment Terms Are Flexible:

Some believe that repayment terms can be altered after signing. While modifications are possible, they must be documented and agreed upon by both parties to be enforceable.

-

Promissory Notes Are Only for Large Amounts:

It is a misconception that promissory notes are only used for substantial loans. They can be used for any amount, making them versatile for both large and small transactions.

-

Once Signed, a Promissory Note Cannot Be Changed:

Many think that once a promissory note is signed, it is set in stone. However, parties can negotiate changes, provided they document any amendments properly.

Understanding these misconceptions can help individuals and businesses navigate their financial agreements more effectively.