Printable Transfer-on-Death Deed Document for Virginia

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Virginia Transfer-on-Death Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | This deed is governed by Virginia Code § 64.2-620 through § 64.2-629. |

| Beneficiary Designation | Multiple beneficiaries can be named, and each can receive a specified share of the property. |

| Revocation | The deed can be revoked at any time before the death of the grantor, ensuring flexibility in estate planning. |

| Execution Requirements | The deed must be signed by the grantor in the presence of a notary public and recorded in the local land records. |

| Tax Implications | Property transferred via this deed may still be subject to estate taxes, depending on the overall value of the estate. |

| Effectiveness | The deed takes effect only upon the death of the grantor, meaning the grantor retains full ownership during their lifetime. |

Key takeaways

Filling out and using the Virginia Transfer-on-Death Deed form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understanding the Purpose: The Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate.

- Complete the Form Accurately: Ensure all required information, such as property details and beneficiary names, is filled out correctly. Mistakes can lead to delays or complications.

- Sign and Notarize: The deed must be signed by the property owner and notarized. This step is crucial for the deed to be legally valid.

- File with the Local Clerk: After completing the deed, it must be recorded with the local circuit court clerk’s office in the county where the property is located. This step finalizes the transfer process.

By following these guidelines, you can ensure that your Transfer-on-Death Deed is executed properly, making the process smoother for your beneficiaries.

Dos and Don'ts

When filling out the Virginia Transfer-on-Death Deed form, it is crucial to follow certain guidelines to ensure the process goes smoothly. Below are some important dos and don’ts to keep in mind.

- Do ensure that you are the sole owner of the property or have the authority to transfer it.

- Do provide accurate and complete information about the property, including the legal description.

- Do sign the deed in the presence of a notary public to validate the document.

- Do record the deed with the appropriate county office to make the transfer effective.

- Don't use vague language when describing the property; clarity is essential.

- Don't forget to include the names of all beneficiaries clearly.

- Don't attempt to make changes after the deed has been notarized; this could invalidate it.

- Don't neglect to consult with a legal professional if you have questions or concerns.

More Transfer-on-Death Deed State Templates

Transfer on Death Deed Utah - A Transfer-on-Death Deed is often less expensive than traditional estate planning methods, like setting up a trust.

To simplify the process of completing this important transaction, you can access our comprehensive resources, including the PDF Templates for the New York Motorcycle Bill of Sale, ensuring all necessary details are captured and the transfer is executed flawlessly.

Transfer on Death Deed Texas Form 2023 - The form facilitates a direct transfer of property title to named beneficiaries when the owner passes away.

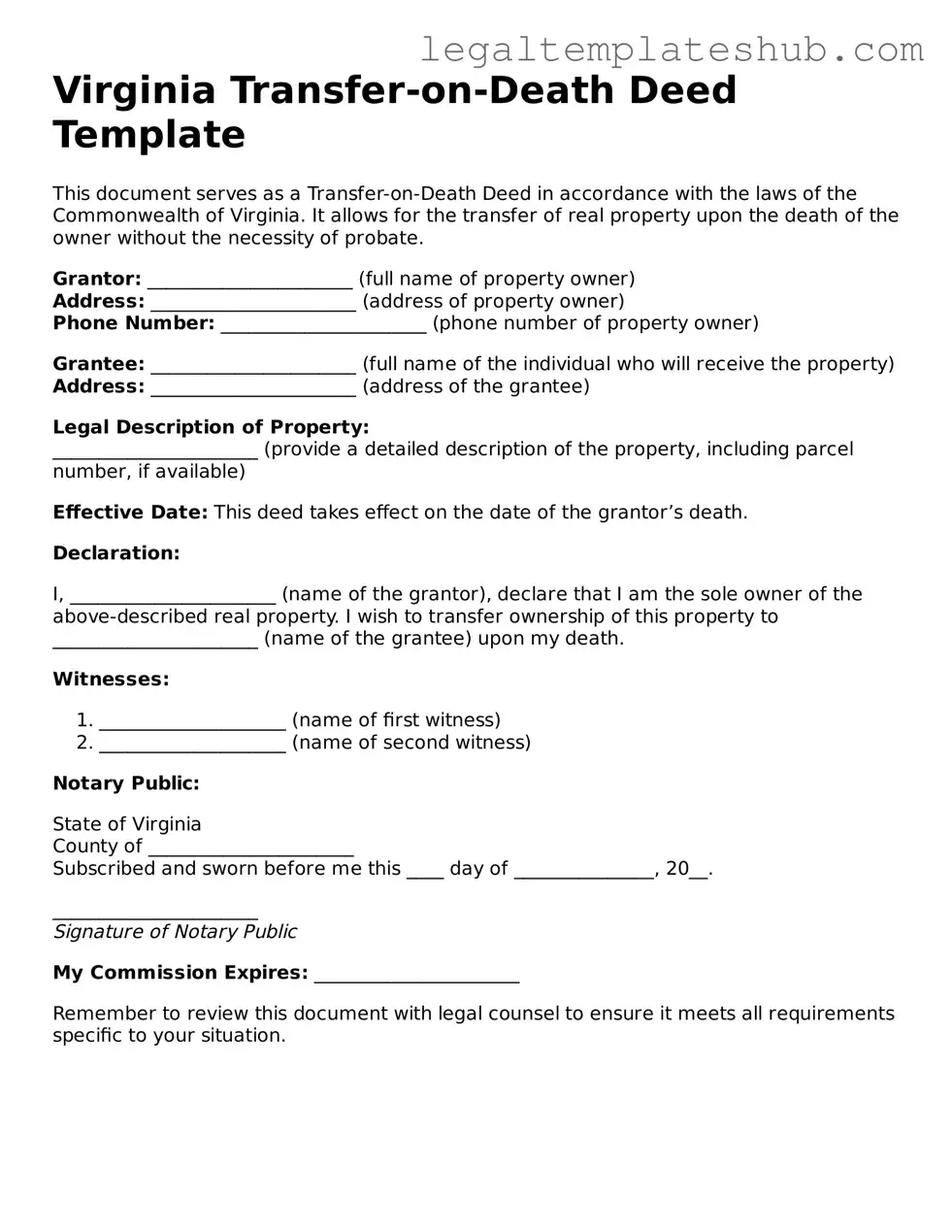

Instructions on Filling in Virginia Transfer-on-Death Deed

After obtaining the Virginia Transfer-on-Death Deed form, the next steps involve filling it out accurately to ensure proper designation of beneficiaries. Follow these instructions carefully to complete the form correctly.

- Begin by entering your name as the grantor in the designated space at the top of the form.

- Provide your address in the appropriate section, ensuring it is complete and accurate.

- Identify the property you wish to transfer. Include a full legal description of the property, which can typically be found on your property deed.

- List the names of the beneficiaries who will receive the property upon your passing. Ensure that each name is spelled correctly.

- Include the address of each beneficiary next to their name.

- Sign and date the form at the bottom. Your signature must be notarized for the deed to be valid.

- Once notarized, make copies of the completed deed for your records and for each beneficiary.

- File the original deed with the local land records office in the county where the property is located.

Following these steps will help ensure that the Transfer-on-Death Deed is completed and filed properly, facilitating a smooth transfer of property ownership in the future.

Misconceptions

- Misconception 1: The Transfer-on-Death Deed is only for wealthy individuals.

- Misconception 2: A Transfer-on-Death Deed avoids all probate issues.

- Misconception 3: The property automatically transfers upon signing the deed.

- Misconception 4: You cannot change or revoke a Transfer-on-Death Deed once it is created.

- Misconception 5: A Transfer-on-Death Deed is the same as a will.

- Misconception 6: The Transfer-on-Death Deed can be used for all types of property.

- Misconception 7: You do not need to file the Transfer-on-Death Deed with the county.

This is not true. Anyone can use a Transfer-on-Death Deed to pass property to their beneficiaries, regardless of their financial situation.

While this deed can help avoid probate for the property it covers, other assets may still need to go through probate.

The transfer does not occur until the owner passes away. Until then, the owner retains full control of the property.

In fact, the owner can revoke or change the deed at any time before their death, as long as the proper procedures are followed.

While both documents deal with property transfer, a Transfer-on-Death Deed specifically transfers property outside of probate, whereas a will goes through the probate process.

This deed is generally limited to real estate. Other types of assets, like bank accounts or personal property, require different methods for transfer.

It is necessary to record the deed with the appropriate county office to ensure that it is valid and enforceable.