Printable Articles of Incorporation Document for Washington

PDF Form Data

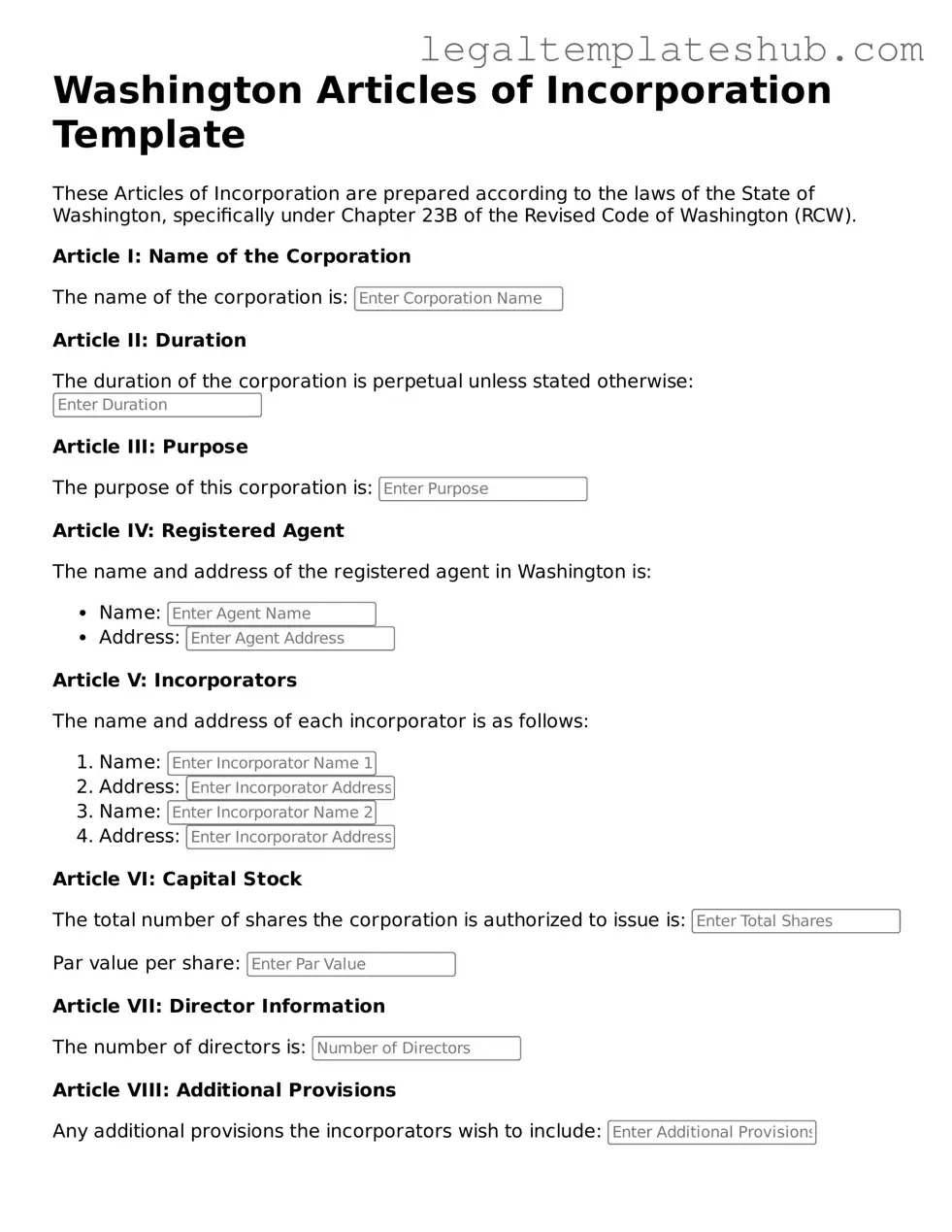

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation form is used to legally establish a corporation in Washington State. |

| Governing Law | This form is governed by the Washington Business Corporation Act, specifically RCW 23B. |

| Filing Requirement | Corporations must file the Articles of Incorporation with the Washington Secretary of State to be recognized as a legal entity. |

| Information Needed | The form requires details such as the corporation's name, registered agent, and the number of shares authorized. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

Key takeaways

When it comes to filling out and using the Washington Articles of Incorporation form, there are several important points to keep in mind. These takeaways will help ensure that your incorporation process goes smoothly and that you meet all necessary requirements.

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They establish your business as a legal entity in Washington State.

- Provide Accurate Information: Fill in all required fields accurately. This includes the corporation's name, registered agent, and business address. Errors can lead to delays or rejection.

- Choose the Right Corporate Structure: Decide whether your corporation will be for-profit or non-profit. This choice affects your tax obligations and operational guidelines.

- File with the Secretary of State: Submit your completed Articles of Incorporation to the Washington Secretary of State. This can often be done online for convenience.

- Stay Informed on Compliance: After incorporation, keep up with ongoing compliance requirements, such as annual reports and taxes. This ensures your corporation remains in good standing.

Dos and Don'ts

When filling out the Washington Articles of Incorporation form, it's important to follow some key guidelines. Here’s a helpful list of things to do and avoid:

- Do provide accurate information about your business name and ensure it complies with state requirements.

- Don't use a name that is too similar to an existing corporation or business entity in Washington.

- Do include the names and addresses of all initial directors.

- Don't forget to specify the purpose of your corporation clearly.

- Do make sure to sign the form where required, as an unsigned form may be rejected.

- Don't leave any required fields blank; incomplete forms can delay processing.

- Do double-check for spelling errors and typos before submitting your form.

By following these guidelines, you can help ensure a smoother incorporation process in Washington.

More Articles of Incorporation State Templates

Virginia Llc Fee - State registration often follows the approval of the Articles.

To facilitate the ownership transfer, it is crucial to use the appropriate documentation, such as a Bill of Sale for Motorcycles, which ensures that all necessary details are accurately recorded and both parties are protected during the transaction.

Ohio Llc Fees - Incorporation through these Articles can facilitate easier growth and expansion.

Pa Llc Forms - Registered agents must have a physical address within the state of incorporation.

Instructions on Filling in Washington Articles of Incorporation

Filling out the Washington Articles of Incorporation form is an important step in establishing your business. After completing the form, you will submit it to the Washington Secretary of State along with the required filing fee. This process will officially register your corporation in the state.

- Obtain the Articles of Incorporation form from the Washington Secretary of State's website or office.

- Fill in the name of your corporation. Ensure the name is unique and meets state requirements.

- Provide the duration of the corporation. Most corporations choose perpetual duration.

- List the purpose of your corporation. Be clear and concise about your business activities.

- Enter the registered agent's name and address. This is the person or entity responsible for receiving legal documents on behalf of the corporation.

- Indicate the number of shares your corporation is authorized to issue.

- Include the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Sign and date the form. All incorporators must provide their signatures.

- Prepare the filing fee. Check the current fee amount on the Secretary of State’s website.

- Submit the completed form and payment to the Washington Secretary of State by mail or in person.

Misconceptions

When it comes to the Washington Articles of Incorporation form, many people hold misconceptions that can lead to confusion. Here’s a list of ten common misunderstandings:

-

Only large companies need Articles of Incorporation.

This is not true. Any business entity, regardless of size, can benefit from incorporation. It provides liability protection and can enhance credibility.

-

The Articles of Incorporation are the same as a business license.

These are distinct documents. The Articles establish your business as a legal entity, while a business license allows you to operate legally within a jurisdiction.

-

Filing Articles of Incorporation is a one-time process.

Incorporation is just the beginning. Businesses must also file annual reports and pay fees to maintain their corporate status.

-

You must have a physical office in Washington to incorporate.

While a registered agent with a physical address in Washington is required, you do not need to have a physical office yourself.

-

All businesses must incorporate as a corporation.

This is a misconception. There are various business structures, such as LLCs and partnerships, that may be more suitable depending on your needs.

-

Incorporation guarantees personal asset protection.

While incorporation generally protects personal assets, it’s not foolproof. Certain actions, like personal guarantees or fraud, can pierce the corporate veil.

-

Articles of Incorporation are difficult to complete.

The form is straightforward. With clear instructions, most people can fill it out without needing legal assistance.

-

You can change your Articles of Incorporation at any time without consequences.

Changes require formal amendments. Failing to follow the proper process can lead to legal complications.

-

Once filed, the Articles of Incorporation cannot be modified.

This is incorrect. You can amend your Articles, but you must follow the state's procedures to do so.

-

Incorporation is too expensive for small businesses.

The costs associated with incorporation can be manageable. Many small businesses find that the benefits outweigh the initial expenses.

Understanding these misconceptions can help you navigate the incorporation process more effectively. Always consider seeking advice tailored to your specific situation.