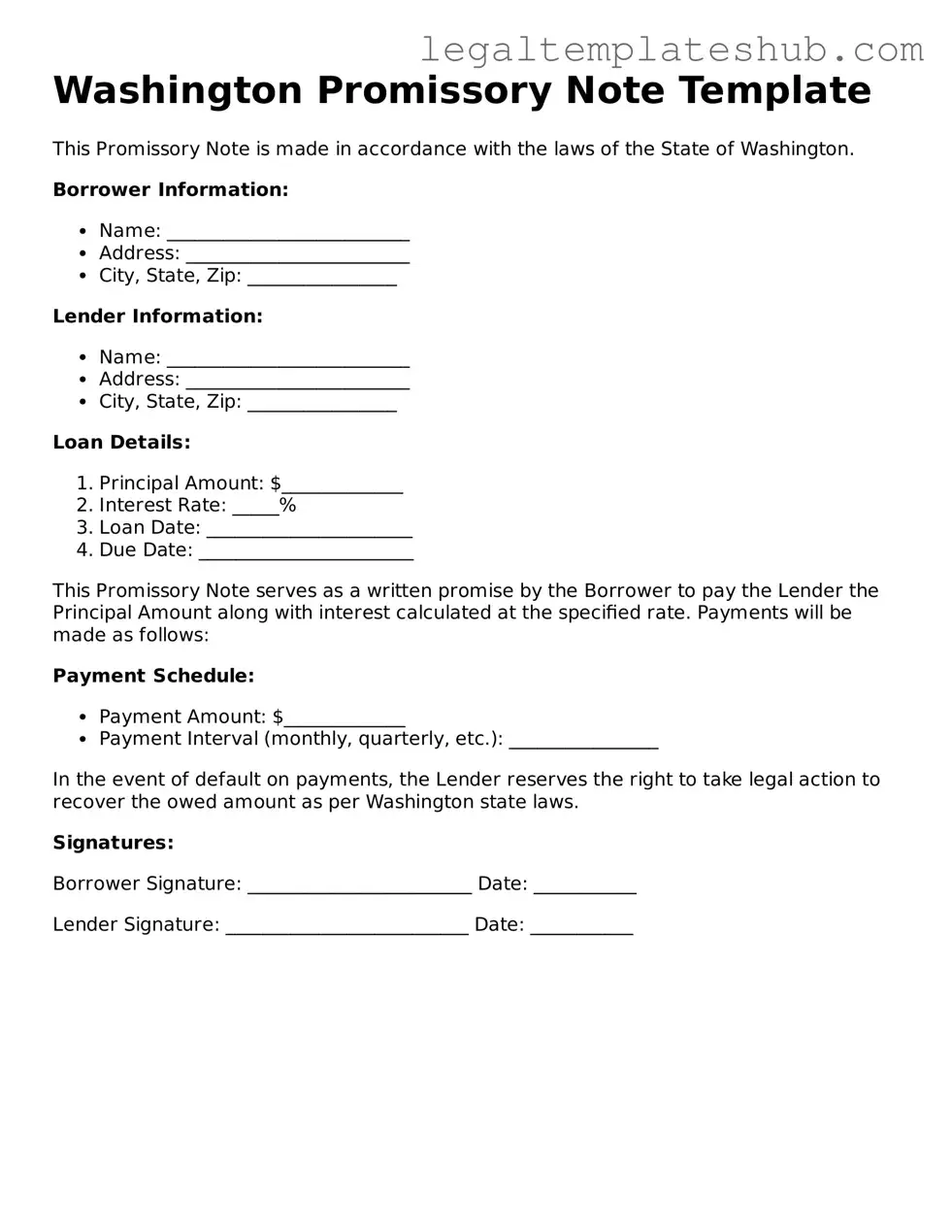

Printable Promissory Note Document for Washington

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Washington Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time. |

| Governing Law | The Washington Promissory Note is governed by the Revised Code of Washington (RCW) Title 62A - Uniform Commercial Code. |

| Interest Rates | Interest rates can be specified in the note, but must comply with Washington state laws regarding usury. |

| Signatures | The note must be signed by the borrower to be enforceable. A witness is not required but can add an extra layer of validity. |

| Payment Terms | Payment terms, including the amount and due date, should be clearly stated to avoid any disputes. |

| Default Consequences | In the event of default, the lender may have the right to initiate legal action to recover the owed amount. |

Key takeaways

When filling out and using the Washington Promissory Note form, keep these key takeaways in mind:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Write the exact amount of money being borrowed in both numbers and words.

- Define the Interest Rate: Include the interest rate, whether it is fixed or variable, and how it will be calculated.

- Outline Payment Terms: Detail the repayment schedule, including the frequency and due dates of payments.

- Include Maturity Date: Clearly state when the loan will be fully paid off.

- Address Late Payments: Specify any penalties for late payments to avoid misunderstandings.

- Discuss Prepayment Options: Indicate whether the borrower can pay off the loan early without penalties.

- Signatures Required: Ensure that both parties sign and date the document to make it legally binding.

- Witness or Notary: Consider having the document witnessed or notarized for added legal protection.

- Keep Copies: Each party should keep a signed copy of the note for their records.

Following these steps can help ensure that the promissory note is clear and enforceable. Take your time to review the document before signing.

Dos and Don'ts

When filling out the Washington Promissory Note form, attention to detail is crucial. Here are nine important dos and don’ts to consider:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable, and ensure it complies with state laws.

- Do outline the repayment schedule in a straightforward manner.

- Don't leave any sections blank; fill in all required fields.

- Don't use ambiguous language that could lead to misunderstandings.

- Don't forget to date the document upon signing.

- Don't overlook the importance of having both parties sign the note.

By following these guidelines, you can ensure that the Promissory Note is both effective and legally sound.

More Promissory Note State Templates

Free Loan Agreement Template Texas - Interest rates on the promissory note can be fixed or variable, depending on the agreement made.

When engaging in a purchase or sale, having a properly completed Florida Bill of Sale is essential to ensure a smooth transaction, providing both parties with a clear record of ownership transfer. This document can be particularly important for significant assets, like vehicles or boats, allowing both buyers and sellers to maintain accurate records for future reference, such as tax implications or registration necessities. For more information and to access a template, you can visit https://floridaformspdf.com/printable-bill-of-sale-form/.

Promissory Note Template Ohio - May include references to collateral if applicable.

Instructions on Filling in Washington Promissory Note

Once you have the Washington Promissory Note form in front of you, the next step is to fill it out accurately. This document serves as a written promise to repay a loan under specific terms. Completing it correctly ensures that both parties understand their rights and obligations.

- Begin by entering the date at the top of the form. This should be the date you are completing the document.

- Next, provide the name and address of the borrower. This identifies who is responsible for repaying the loan.

- Include the name and address of the lender. This is the individual or entity that is providing the loan.

- Clearly state the principal amount of the loan. This is the total amount borrowed.

- Specify the interest rate, if applicable. This should be expressed as a percentage.

- Indicate the repayment schedule. This includes the frequency of payments (e.g., monthly, quarterly) and the due dates.

- Outline any late fees or penalties for missed payments. This informs the borrower of potential additional costs.

- Include any prepayment terms. This specifies if the borrower can pay off the loan early without penalties.

- Both the borrower and lender should sign and date the document at the bottom. This signifies agreement to the terms outlined in the note.

After completing the form, it is advisable to keep copies for both the borrower and lender. This ensures that both parties have a record of the agreement and its terms.

Misconceptions

Understanding the Washington Promissory Note can be challenging, especially with the various misconceptions that exist. Here are ten common misunderstandings, along with clarifications to help you navigate this important financial document.

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, they can vary significantly based on state laws and specific terms agreed upon by the parties involved.

- A Promissory Note Must Be Notarized: Some people think notarization is mandatory. While having a note notarized can add an extra layer of credibility, it is not a legal requirement in Washington.

- Only Banks Can Issue Promissory Notes: This misconception suggests that only financial institutions can create these documents. In fact, any individual or business can issue a promissory note as long as it meets legal requirements.

- Promissory Notes Are Only for Loans: While often associated with loans, these notes can also be used for other types of financial agreements, such as payment for services or goods.

- Interest Rates Must Be Included: Some believe that every promissory note must specify an interest rate. However, a note can be created without interest, making it a zero-interest loan.

- They Are Not Legally Binding: A common myth is that promissory notes lack legal enforceability. When properly drafted, they are indeed legally binding and can be enforced in court.

- Only Written Notes Are Valid: While written notes are standard, oral agreements can also be valid. However, proving the terms of an oral agreement can be much more challenging.

- You Cannot Modify a Promissory Note: Some think that once a note is signed, it cannot be changed. In reality, parties can amend the terms if both agree, but this should be documented properly.

- All Promissory Notes Are Public Records: Many assume that these notes are filed publicly. In Washington, promissory notes are private agreements and are not automatically part of public records.

- Defaulting on a Promissory Note Has No Consequences: This misconception can be dangerous. Defaulting can lead to legal action and damage to one’s credit score, just like any other type of loan.

By debunking these myths, individuals can better understand the Washington Promissory Note and use it effectively in their financial dealings. Always consider seeking professional advice to ensure compliance with the law and to protect your interests.