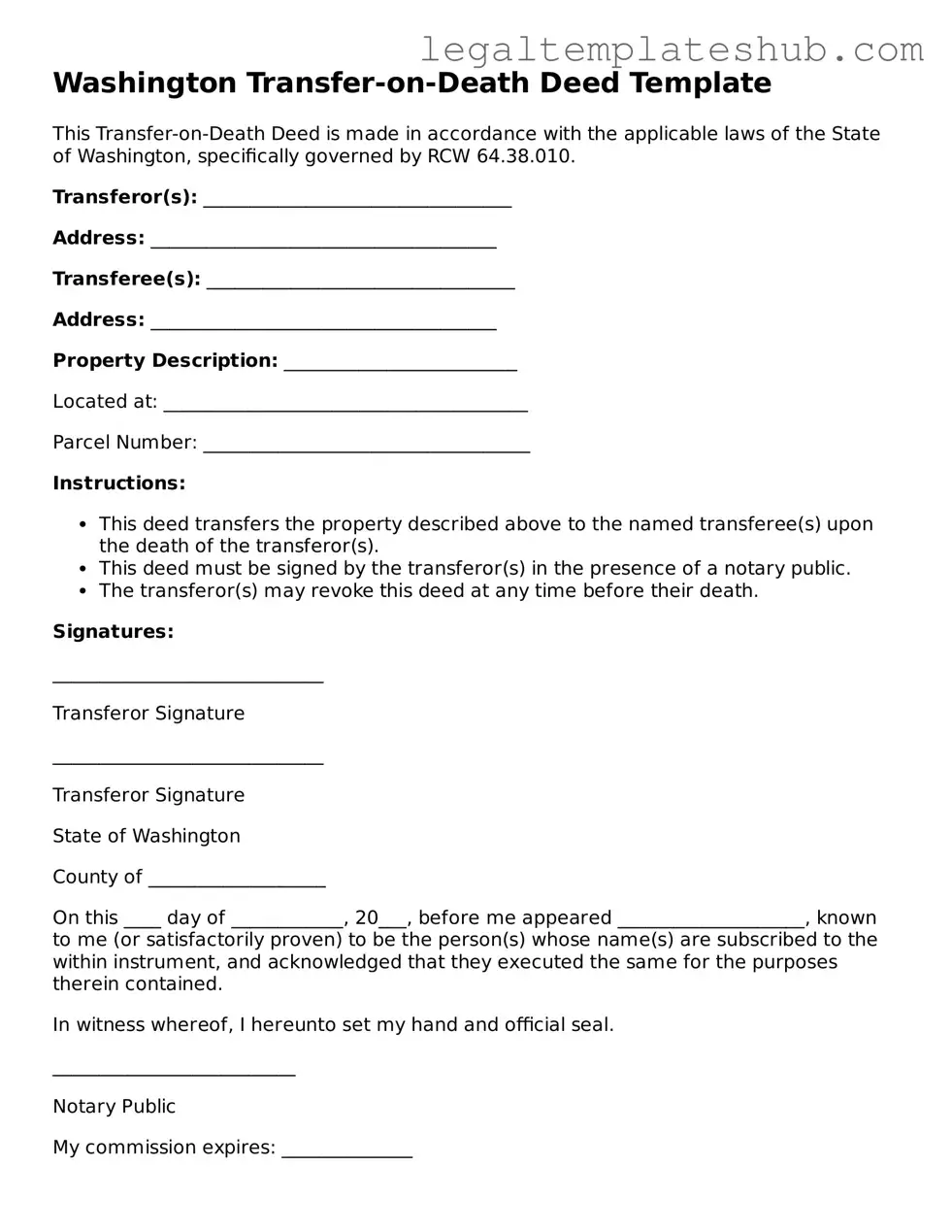

Printable Transfer-on-Death Deed Document for Washington

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in Washington to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Washington Transfer-on-Death Deed is governed by RCW 64.380, which outlines the requirements and procedures for creating and executing the deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed, and they can change or revoke the deed at any time before their death. |

| No Immediate Transfer | Ownership of the property does not transfer to the beneficiary until the property owner's death, allowing for continued control during their lifetime. |

| Filing Requirements | The TOD deed must be recorded with the county auditor where the property is located to be effective, ensuring public notice of the transfer intent. |

Key takeaways

Here are some key takeaways about filling out and using the Washington Transfer-on-Death Deed form:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death.

- This deed must be signed by the property owner and notarized to be valid.

- It is essential to provide a clear legal description of the property to avoid confusion in the future.

- Beneficiaries can be individuals or entities, but they must be specified clearly in the deed.

- Filing the deed with the county auditor's office is necessary for it to take effect.

- Property owners can revoke or change the beneficiaries at any time before their death.

- Using this deed can help avoid probate, making the transfer of property simpler and faster for beneficiaries.

Dos and Don'ts

When filling out the Washington Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure the document is valid and effective. Below is a list of ten things to do and not do during this process.

- Do provide accurate information about the property owner and the property itself.

- Do clearly identify the beneficiaries who will receive the property upon the owner's death.

- Do sign the deed in the presence of a notary public to validate the document.

- Do ensure that the deed is recorded with the county auditor's office after signing.

- Do keep a copy of the recorded deed for your records.

- Don't use vague language when describing the property.

- Don't forget to check for any outstanding liens or mortgages on the property.

- Don't leave out the legal description of the property.

- Don't attempt to make changes to the deed after it has been signed and notarized.

- Don't neglect to inform the beneficiaries about the existence of the deed.

More Transfer-on-Death Deed State Templates

Affidavit for Transfer Without Probate Ohio - It is a valuable resource for individuals who wish to retain control over their property until death.

The necessary Durable Power of Attorney documentation allows individuals to establish a trusted person to handle their financial responsibilities, ensuring that their affairs are properly managed even during times of incapacity. This legal instrument plays a critical role in safeguarding the principal’s assets and maintaining continuity in financial decision-making.

Transfer on Death Deed Texas Form 2023 - By utilizing a Transfer-on-Death Deed, property owners can avoid initiating complex probate procedures.

Instructions on Filling in Washington Transfer-on-Death Deed

After obtaining the Washington Transfer-on-Death Deed form, it is important to complete it accurately to ensure proper transfer of property upon death. Follow the steps below to fill out the form correctly.

- Begin by entering the name of the property owner in the designated section. This should include the full legal name as it appears on the property title.

- Provide the address of the property. Ensure that the address is complete, including street number, street name, city, and zip code.

- Identify the legal description of the property. This can often be found on the current deed or property tax statement. It is important to be precise in this section.

- List the name(s) of the beneficiary or beneficiaries who will receive the property. Include full legal names, and if there are multiple beneficiaries, separate them with commas.

- Sign the form. The property owner must sign the deed in the presence of a notary public.

- Have the signature notarized. The notary will verify the identity of the signer and witness the signing of the document.

- Submit the completed deed to the county auditor’s office where the property is located. Ensure that it is filed according to local regulations.

After submitting the form, it is advisable to keep a copy for personal records. The deed will take effect upon the death of the property owner, transferring ownership to the designated beneficiary or beneficiaries without the need for probate.

Misconceptions

Understanding the Washington Transfer-on-Death Deed can be challenging. Here are six common misconceptions about this form:

- It automatically transfers property upon death. Many people believe that once the deed is signed, the property immediately transfers to the beneficiary upon the owner's death. In reality, the transfer only occurs after the owner's passing and when the deed is properly recorded.

- It eliminates the need for a will. Some think that using a Transfer-on-Death Deed means they no longer need a will. However, this is not true. A will is still important for addressing other assets and personal wishes that may not be covered by the deed.

- Beneficiaries can access the property before the owner's death. There is a belief that beneficiaries can take control of the property while the owner is still alive. This is incorrect; the owner retains full control of the property until their death.

- It is a complicated legal process. Many assume that creating a Transfer-on-Death Deed is a complicated process requiring extensive legal knowledge. In fact, it can be a straightforward procedure that homeowners can often complete with minimal assistance.

- All types of property can be transferred. Some people think that any type of property can be transferred using this deed. However, there are specific restrictions, such as certain types of real estate and properties with existing liens or mortgages.

- It is irrevocable once signed. A common misconception is that the deed cannot be changed once it has been signed. In truth, the owner can revoke or change the deed at any time while they are alive, as long as they follow the proper procedures.